Prime Day isn’t a dress rehearsal anymore—it’s a full-scale performance event that reveals critical insights about how brands should approach the peak holiday season. Our analysis of both July and October 2025 Prime Days shows a dramatic shift in how marketers are treating these tentpole events, with brand participation exploding and certain categories pulling away from the pack.

Here’s what the data tells us about winning strategies for Black Friday and Cyber Monday.

1. Prime Day has arrived as a strategic fixture for brand momentum

Key Finding: Brand participation surged 150% year-over-year for July Prime Day and 90% year-over-year for October Prime Day. This isn’t just growth—it’s a fundamental shift in how marketers view Amazon’s shopping events.

Prime Day has officially graduated from “nice-to-have promotional opportunity” to “must-participate tentpole event” on par with Black Friday and Cyber Monday. When participation nearly doubles year-over-year twice in a single year, you’re witnessing a sea change in strategic planning.

What This Means for BF/CM: If your competitors are treating Prime Day as a full-scale launch pad, they’re building brand awareness and capturing early holiday budgets months before November. The brands that dominated Prime Day aren’t starting from scratch on Black Friday—they’re building on existing momentum.

Long story short: Prime Day is no longer the opening act. It’s become its own main event, and the brands treating it that way are setting themselves up for a stronger position heading into the traditional holiday shopping season.

2. Electronics and Health & Wellness are the breakout categories

The category winners tell a clear story about where smart money is flowing:

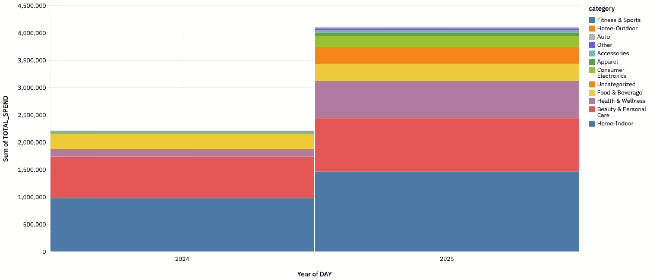

July Prime Day:

- Electronics: 18x year-over-year growth

- Health & Wellness: 7.75x YoY growth

- Food & Beverage: 3.45x YoY growth

October Prime Day:

- Electronics: 7.3x YoY growth

- Health & Wellness: 3.4x YoY growth

- Home (Indoor): 45% YoY growth

Electronics and Health & Wellness aren’t just growing. They’re exploding. This likely reflects sophisticated Q4 planning by performance marketers who recognize that these categories align with holiday shopping behavior and gift-giving occasions.

Health & Wellness deserves special attention: it’s not only scaling aggressively but also maintaining strong ROAS performance despite increased spend. This is the rare combination of growth with efficiency that every marketer is chasing.

Strategic Insight: These aren’t random spikes. Electronics and Health & Wellness brands are clearly building their Q4 strategies around Prime Day as a critical acquisition and awareness period. If you’re in one of these categories and sitting out Prime Day, you’re giving up ground to competitors who are using it to warm up their audience for Black Friday.

3. Growth is strong, but margins are tightening

Here’s the uncomfortable truth hiding in the growth numbers: overall ROAS was lower in 2025 than 2024 for most categories during October Prime Day, and customer acquisition costs increased across the board.

What’s Happening:

- More brands are competing for the same consumer attention

- Higher CPMs and CPCs as auction competition intensifies

- Consumers gravitating toward brands they already know and trust

- New customer acquisition becoming more expensive

The exception? Health & Wellness managed to maintain stronger ROAS despite scaling spend—a signal that this category’s product-market fit with Prime Day shopping behavior is particularly strong.

The BF/CM Implication: If efficiency was under pressure during Prime Day, expect it to be even more challenged during Black Friday and Cyber Monday when literally every brand goes all-in. This means:

- Pre-holiday brand building matters more: The brands consumers already know will have an advantage

- Creative quality becomes a differentiator: When everyone’s spending, creative excellence cuts through

- First-party data and retargeting win: Acquiring new customers is expensive; converting warm audiences is the efficiency play

Don’t expect to overcome higher CACs with more spend. The brands that will win are those investing in brand awareness earlier (like during Prime Day) to make their Black Friday campaigns more efficient.

4. Beauty’s strategy raises questions

One interesting category stood out: Beauty spend increased 28% year-over-year during Prime Day but this was mostly driven by brands new to the October event. Brands showing up for Prime Day again only increased spend by 7% year-over-year.

This dramatically smaller increase is particularly striking when contrasted with the aggressive growth in Electronics and Health & Wellness. Is this a strategic shift by Beauty brands, or a signal of broader demand softness in the category?

Possible Explanations:

- Beauty brands may be reallocating budgets toward owned channels and influencer partnerships

- Category saturation on Amazon could be driving brands to differentiate elsewhere

- Beauty’s gifting season may peak differently, with brands conserving budget for December

- Macro economic factors may be hitting discretionary beauty spending harder

What This Means for Other Categories: Beauty’s conservative spending creates a potential opportunity. If competitive pressure is lower, brands in adjacent categories (personal care, wellness) might find efficiency gains by capturing attention Beauty brands are leaving on the table.

For Beauty brands specifically: if this was a strategic choice to preserve budget for later in Q4, make sure you’re ready to deploy that capital effectively during Black Friday. If it’s a demand issue, November won’t solve it—you’ll need to rethink your value proposition and promotional strategy.

5. Event duration matters

July Prime Day ran for four days; October maintained Amazon’s traditional two-day format. The result? July saw stronger revenue impacts, but October’s rising brand participation may be the more important signal.

The Duration Effect:

- Shorter events create urgency but compress conversion windows

- Longer events allow for more customer research and consideration

- Two-day format may have contributed to muted revenue growth relative to spend increases

But Here’s the Twist: Revenue started pouring in on the second day of October Prime Day, with ROAS jumping from 1.4 early Wednesday to 2.5 by the end of the event. This delayed conversion pattern suggests consumers are using Prime Day for research and comparison, even if they don’t convert immediately.

Even more revealing: nearly 90% of Amazon revenue during Prime Day was driven by halo effects from other channels, not direct Amazon Ads attribution.

The BF/CM Lesson: Black Friday and Cyber Monday create a similar compressed timeframe with massive consumer intent. But like Prime Day, the true impact extends well beyond the immediate event window. The brands measuring only direct attribution are dramatically underestimating their marketing effectiveness.

Strategic Recommendations:

- Don’t panic if Day 1 performance looks soft—conversion velocity often builds

- Track revenue for at least a week post-event to capture delayed conversions

- Invest in brand-building across channels to maximize halo effects

- Use multi-touch attribution to understand the full customer journey

The bottom line: Prime Day is your BF/CM preview reel

Prime Day has evolved from a mid-summer promotional event to an essential data collection opportunity. The brands that participated aggressively in both July and October now have critical intelligence about:

- Which creative messages resonate with their audience

- How their category performs under intense competitive pressure

- What their true customer acquisition costs look like at scale

- Which channels drive the strongest halo effects

The brands that sat out Prime Day? They’re walking into Black Friday and Cyber Monday blind, without the benefit of a dress rehearsal.

Your Action Plan for BF/CM:

- Double down on what worked on Prime Day. If Electronics and Health & Wellness efficiency held strong, these categories have product-market fit with tentpole events.

- Plan for efficiency compression. Higher CACs are the new normal during peak events. Build your Black Friday strategy around retargeting and brand-building, not cold acquisition.

- Extend your measurement window. With ROAS doubling from Day 1 to Day 2 during October’s Prime Day and 90% of revenue driven by halo effects, your immediate metrics are lying to you.

- Start earlier. The 150% growth in Prime Day participation shows brands are front-loading their Q4 strategies. If you wait until November to turn on spending, you’re already behind.

Prime Day is growing and quickly becoming the testing ground where Q4 winners and losers are determined. The question isn’t whether to participate next year. It’s whether you learned enough from this year’s events to dominate the ones ahead.

Ready to turn these Prime Day insights into a winning Black Friday strategy? The brands that treat data as their competitive advantage are the ones that will cut through the noise when everyone else is just spending louder.

Scott Chang specializes in transforming complex marketing performance data into clear, actionable insights for operators and brand leaders. At Prescient AI, he helps interpret the proprietary MMM and establishes performance benchmarks that equip decision-makers with trusted guidance on marketing efficiency. Previously, Scott led Marketing Analytics at ThirdLove, where he built frameworks to evaluate cross-channel performance and guide investment decisions for a high-growth ecommerce brand. Scott’s analyses at Prescient are designed to be both methodologically rigorous and practically useful.