A retailer opens a flagship store in a busy shopping district. Customers browse the displays, try on products, and fall in love with the brand. Then they walk across the street to a department store and buy the same product there because it’s more convenient, they have a gift card, or they’re already checking out with other items.

The flagship store gets zero credit for the sale. The department store’s metrics look amazing. And the retailer, looking only at direct store revenue, concludes the flagship isn’t worth the investment.

This is exactly what’s happening with Snapchat and Amazon. Brands discover that Snapchat campaigns “don’t convert well” based on platform metrics, cut the spend, and watch their Amazon sales mysteriously decline. The connection is invisible to traditional attribution, but it’s costing brands millions in misattributed revenue.

Key takeaways

- Snapchat drives a disproportionately large share of halo revenue to Amazon compared to any other major advertising platform

- Nearly half of Snapchat’s total incremental value for omnichannel brands flows through Amazon purchases rather than direct-to-consumer conversions

- Brands evaluating Snapchat solely on Snapchat-attributed conversions miss the channel’s primary function: creating demand that converts on marketplaces

- Amazon attribution consistently fails to connect marketplace purchases back to Snapchat awareness, making the channel appear ineffective when it’s actually driving substantial incremental sales

- For brands with Amazon distribution, measuring Snapchat’s Amazon halo is central to understanding the channel’s true ROI

Understanding Snapchat’s unique halo profile

Not all halo effects are created equal. While most awareness channels generate spillover value across branded search, organic traffic, and direct visits, Snapchat exhibits a distinctly different pattern: it disproportionately drives demand to Amazon.

This isn’t a minor difference. When you examine where Snapchat’s halo effects land, Amazon represents the single largest destination for Snapchat-driven demand, surpassing even organic traffic and branded search in many cases. This pattern is more pronounced with Snapchat than with Meta, Pinterest, or even Google Ads.

TikTok is the only other platform showing comparable marketplace halo behavior, but across aggregated benchmark data, Snapchat’s Amazon contribution often meets or exceeds TikTok’s impact.

Why this matters for your budget decisions

Traditional attribution shows you Snapchat conversions. It doesn’t show you the person who discovered your product through a Snapchat ad, searched for it on Amazon two days later, and bought it there because they were already purchasing other items and wanted free Prime shipping.

Platform metrics will tell you that Snapchat campaign delivered a 1.5x ROAS. Prescient’s marketing mix modeling will tell you it delivered a 4x ROAS when you include the Amazon lift it generated. That gap represents real revenue you’re leaving on the table when you optimize based on incomplete data.

How Snapchat drives Amazon performance

The customer journey from Snapchat to Amazon follows a predictable pattern that traditional attribution is structurally incapable of measuring.

Discovery happens on Snapchat

Someone scrolling through Snapchat Stories sees your product in a compelling context. Maybe it’s a skin care routine, a home organization transformation, or a fashion try-on. The ad creates awareness and consideration, but the user doesn’t click through. They’re not ready to buy right now, and interrupting their social media experience to visit an unfamiliar e-commerce site feels like friction.

Intent forms over time

The product stays in their mind. Over the next few days, they might see your content again (organic or paid), mention it to a friend, or simply remember it when a need arises. The initial Snapchat exposure planted the seed, but the purchase decision develops gradually.

Conversion happens on Amazon

When they’re ready to buy, they don’t type your URL into a browser. They open Amazon, the platform where they’re already logged in, where they have payment saved, where they trust the return policy, and where they can bundle your product with other purchases to hit the free shipping threshold.

They search for your brand or product category, find you, and buy. Amazon attributes this to “organic” or “Amazon search.” Your Snapchat campaign, which created the entire demand signal, gets zero credit.

The attribution failure

Amazon has no idea the person saw your Snapchat ad. Snapchat has no idea the person later bought on Amazon. Your attribution platform sees a Snapchat campaign that “didn’t convert” and an Amazon listing that’s “organically successful.”

The cause and effect relationship is invisible to everyone except Prescient, because we’re tracking how Snapchat spend correlates with Amazon revenue across time.

What the benchmark data shows

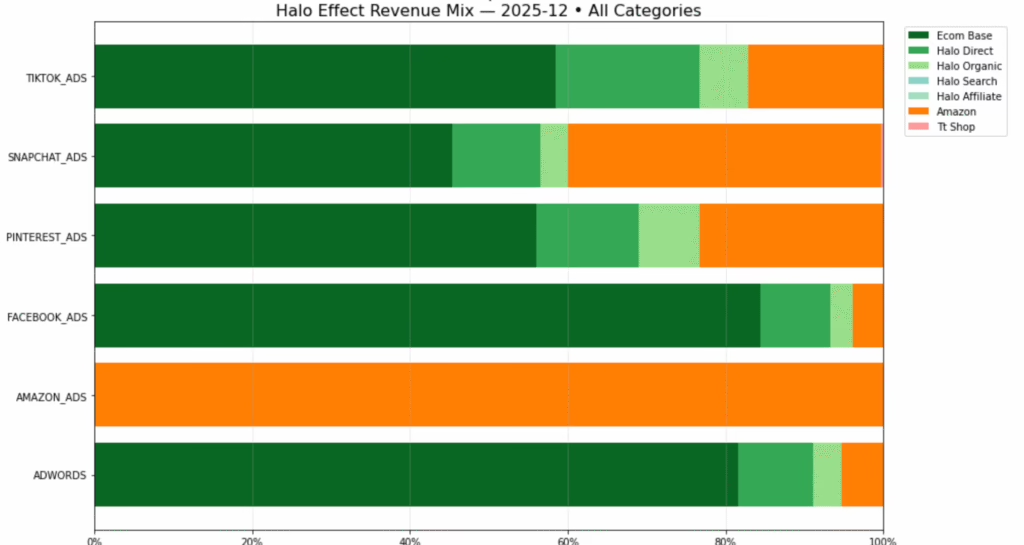

The chart reveals the composition of halo effects by channel, breaking down where each platform’s spillover value lands. For Snapchat, the orange segment—representing TikTok Shop and Amazon marketplace revenue—is substantially larger than for any other channel except TikTok itself.

While Facebook Ads generates halo effects primarily through direct traffic, organic search, and branded search (shown in various shades of green), Snapchat generates a massive share of its total value through marketplace purchases (orange).

This means that for omnichannel brands, Snapchat functions less as a direct-to-consumer driver and more as an Amazon demand creation engine. The channel’s economic value is overwhelmingly tied to its ability to send purchase-ready customers to marketplaces rather than to owned e-commerce sites.

The cost of missing this connection

Brands that don’t measure Snapchat’s Amazon halo make three costly mistakes.

Mistake #1: Cutting Snapchat spend based on platform metrics

When Snapchat campaigns show a 1.5–2x ROAS in platform reporting, they look borderline or unprofitable compared to other channels. Brands conclude Snapchat “doesn’t work” for their product and reallocate budget to Google or Meta.

Three to four weeks later—once the lag between awareness and marketplace conversion plays out—Amazon sales decline. But by then, the connection isn’t obvious. The brand attributes the Amazon decline to increased competition, seasonal shifts, or algorithm changes, never realizing they shut off the demand creation engine feeding their marketplace performance.

Mistake #2: Over-crediting Amazon “organic” performance

Amazon Ads and Amazon SEO get credit for conversions that Snapchat created. This makes Amazon initiatives look more efficient than they actually are, leading to over-investment in capturing existing demand rather than creating new demand.

Brands pour budget into Amazon Sponsored Products, optimizing for shoppers who are already searching for their brand name, never realizing those branded searches were generated by Snapchat campaigns that received no attribution credit.

Mistake #3: Misunderstanding channel roles

Without visibility into where halo effects land, brands treat Snapchat as a generic awareness channel and Amazon as a conversion channel. In reality, Snapchat-to-Amazon functions as an integrated demand creation and fulfillment system.

Snapchat isn’t competing with your Amazon strategy, it’s powering it. But if you measure the two in isolation, that relationship remains invisible.

How to capture this value

Recognizing that Snapchat drives Amazon revenue is the first step. Measuring it properly and incorporating it into budget decisions is the second.

Step 1: Measure Snapchat-to-Amazon lift with marketing mix modeling

Prescient’s marketing mix modeling tracks how changes in Snapchat spend correlate with changes in Amazon revenue, controlling for seasonality, promotions, and other marketing activities. This reveals the causal relationship that attribution platforms miss.

When you see that a $10,000 increase in Snapchat spend correlates with a $25,000 lift in Amazon revenue (after accounting for other factors), you’ve quantified the halo effect that traditional metrics ignore.

Step 2: Adjust your Snapchat ROI targets

If you’re evaluating Snapchat purely on Snapchat-attributed conversions, you’re measuring maybe 30–40% of its actual value. Adjust your efficiency targets to reflect total incremental value, including marketplace halo.

A Snapchat campaign delivering 2x ROAS on platform might actually deliver 4–5x ROAS when Amazon lift is included. That changes it from a marginal performer to one of your most efficient channels.

Step 3: Align Snapchat creative with Amazon purchase behavior

Knowing that Snapchat drives Amazon conversions should influence your creative strategy. Focus on building product awareness and consideration rather than forcing immediate clicks. Highlight product benefits, social proof, and use cases that make people remember your brand when they’re later shopping on Amazon.

Test messaging that assumes the viewer will search for your product later rather than clicking through now. Phrases like “search for [brand name] on Amazon” or “available on Amazon Prime” align the campaign with the actual customer journey.

Step 4: Coordinate Snapchat and Amazon investment

Scale Snapchat and Amazon efforts together rather than treating them as independent channels. When you increase Snapchat awareness spend, expect Amazon performance to improve 2–3 weeks later. When you cut Snapchat, brace for downstream Amazon declines.

Brands that understand this relationship can create compounding growth by timing awareness surges to precede high-conversion periods. Launch Snapchat campaigns four weeks before Prime Day or Black Friday, knowing the demand you’re creating will convert during the peak window.

What you’re missing without this insight

For brands with significant Amazon distribution, failing to measure Snapchat’s marketplace halo means systematically underinvesting in one of the most efficient demand creation channels available.

You’re not just leaving Snapchat revenue on the table, you’re leaving Amazon revenue on the table, too. The budget you cut from Snapchat doesn’t just reduce Snapchat conversions; it reduces total company revenue because the Amazon lift disappears too.

And because the connection is invisible to standard attribution and open-source MMMs, you’ll never know why your Amazon performance plateaued or why your branded search volume declined. You’ll optimize harder on Amazon, increase your Amazon Ads spend, and wonder why you’re fighting for the same customers at higher costs instead of expanding the pool.

How Prescient uncovers Snapchat’s Amazon impact

The analysis presented here comes from Prescient’s marketing mix modeling platform, which tracks demand creation and spillover effects across all channels and purchase destinations, including marketplaces.

We measure how Snapchat spend influences not just Snapchat-attributed conversions, but also Amazon sales, branded search volume, organic traffic, and every other channel where demand ultimately converts. This gives you visibility into the full economic impact of your awareness investment rather than the incomplete picture provided by platform attribution.

For omnichannel brands, this capability is the difference between seeing 30% of your Snapchat value and seeing 100% of it.

If you’re selling on Amazon and not measuring how your upper-funnel channels drive marketplace performance, you’re making budget decisions with half the data. Book a demo to see how Prescient illuminates the relationship between Snapchat and Amazon in the platform.