A basketball team signs a superstar center who averages 25 points per game. The front office celebrates the scoring boost, but something unexpected happens: the point guard’s assists jump by 40%, the shooting guard’s three-point percentage climbs, and suddenly role players are having career years. The center’s true value isn’t just the 25 points on the stat sheet, it’s how those points force defenses to collapse, creating open shots for everyone else.

Marketing channels work the same way. When you evaluate them solely on direct conversions, you’re reading only part of the box score. The channels driving the most revenue for your brand in 2026 aren’t necessarily the ones claiming credit in your marketing attribution reports. They’re the ones creating the conditions for everything else to work better.

Key takeaways

- Halo effects represent the spillover value channels create beyond their direct conversions, often showing up as organic traffic, branded search, and direct visits

- Snapchat, Pinterest, and TikTok rank among the highest halo contributors across DTC brands, generating 50–70% of their total impact through indirect channels

- Platforms that look “inefficient” on last-click or platform-reported ROAS often generate more total value than high-converting channels when halo effects are measured properly

- Ignoring halo effects systematically undervalues upper-funnel investment and leads to chronic underspending on demand-creation channels

- Marketing mix modeling reveals these hidden contributions by tracking how awareness campaigns influence downstream performance across all channels

Understanding halo effects, the hidden half of marketing performance

Your paid social campaign introduces someone to your brand. They don’t click the ad, but three days later they Google your brand name and buy. Your attribution platform gives the social campaign zero credit. Prescient’s marketing mix model gives it most of the credit.

That gap is the halo effect, and it’s where most of your marketing value actually lives.

How halo effects work

Halo effects occur when marketing activity in one channel creates downstream impact that converts through different channels. Someone sees your TikTok video but searches your brand on Google. Someone discovers you through Pinterest but types your URL directly into their browser. Someone watches your YouTube pre-roll but finds you again through Instagram two weeks later.

Traditional attribution methods miss these connections entirely because they rely on cookies, clicks, and device tracking (other MMMs don’t track it because they can’t calculate). If a user doesn’t click your ad and convert in the same session, most platforms give that campaign zero credit, even when it was the reason the person knew your brand existed.

This creates a systematic bias where channels that capture existing demand (branded search, retargeting, direct traffic) look artificially effective, while channels that create demand (prospecting, awareness, discovery platforms) look artificially weak.

Why halo effects matter more than ever

Privacy restrictions have made this measurement gap worse. As tracking capabilities decline, more genuine marketing impact flows through channels that attribution can’t see. The result is that the platforms most responsible for growth—the ones building your brand and expanding your addressable audience—appear to underperform.

Brands that optimize based on last-click or platform-reported metrics systematically underinvest in the channels driving their long-term growth. They cut awareness spend because it “doesn’t convert,” then wonder why their conversion campaigns get more expensive and less effective six months later.

Understanding halo effects isn’t just about better measurement. It’s about making budget decisions that reflect how marketing actually influences buyer behavior.

The highest halo contributing channels for 2026

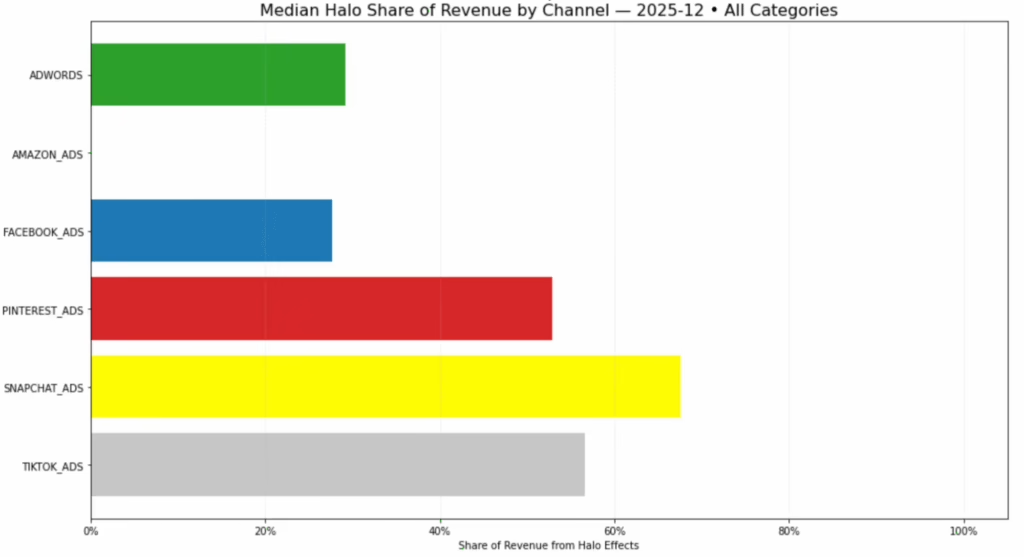

Based on aggregated marketing mix modeling data across DTC brands in 2025, these channels generate the most spillover value relative to their direct attribution. The median halo share of revenue represents the percentage of each channel’s total impact that shows up through other channels rather than as directly attributed conversions.

Snapchat (73% median halo share)

Snapchat tops the list as the highest halo contributor among major advertising platforms. Nearly three-quarters of Snapchat’s true value appears outside of Snapchat-attributed conversions, flowing instead through branded search, organic traffic, direct visits, and other paid channels.

This positioning makes Snapchat neither a pure conversion channel nor a traditional awareness play. Snapchat is not a conversion channel. Think of it as a conversion accelerator. Its primary function is building demand that ultimately converts through search, marketplaces, and direct traffic.

Brands evaluating Snapchat solely on platform-reported ROAS or last-click attribution will systematically undervalue the channel and miss the demand-creation role it plays within the broader media mix. Snapchat’s contribution is most visible when tracked through Marketing Mix Modeling, which captures how awareness built on Snapchat influences performance across the entire funnel.

Pinterest (62% median halo share)

Pinterest operates as a discovery and inspiration platform where users actively seek ideas and products, but conversion typically happens elsewhere. The majority of Pinterest’s impact manifests through branded search lifts, organic traffic increases, and improved performance in conversion-focused channels.

Because Pinterest users are often in early research phases, direct conversion rates understate the channel’s influence. The platform excels at creating mental availability that translates into conversions days or weeks later through channels that receive attribution credit.

TikTok (58% median halo share)

TikTok’s algorithm-driven discovery model introduces brands to audiences who may not convert immediately but develop awareness and consideration. More than half of TikTok’s total contribution appears through downstream channels, particularly branded search and direct traffic.

The platform’s strength lies in viral discovery and content-driven brand building rather than direct response. Brands that treat TikTok purely as a performance channel based on pixel data miss the broader ecosystem effects that drive long-term value.

Google Ads and Meta (25–30% median halo share)

Google Ads (including both Search and Performance Max) and Meta platforms (Facebook and Instagram) exhibit lower but still meaningful halo shares. Approximately one-quarter to one-third of their total value flows through indirect channels.

These platforms sit closer to the bottom of the funnel and capture more existing demand, which explains why their direct attribution more closely reflects their true contribution. However, even high-converting channels generate spillover value that traditional attribution misses.

Amazon Ads (minimal halo share)

Interestingly, Amazon Ads shows minimal halo contribution. This likely reflects Amazon’s role as a point-of-purchase platform where discovery and conversion happen within the same ecosystem. When users search for and buy products on Amazon, the attribution chain stays contained within Amazon’s walled garden.

This doesn’t mean Amazon Ads lacks value, it means the value is primarily direct and captured within Amazon’s own attribution. For brands selling omnichannel, Amazon Ads functions differently than discovery platforms that drive awareness which converts elsewhere.

What you’re missing without halo effect measurement

Brands that don’t measure halo effects face three compounding problems.

First, they chronically underspend on the channels driving sustainable growth. When Snapchat, Pinterest, and TikTok appear to deliver 2x ROAS based on platform metrics, but actually deliver 4–5x when halo effects are included, budget gets reallocated away from the exact channels expanding the top of the funnel.

Second, they overestimate the standalone performance of bottom-funnel channels. Branded search and retargeting look artificially effective when they’re given credit for conversions that wouldn’t exist without upper-funnel investment. This creates a false sense of efficiency that breaks down when awareness spend is cut.

Third, they lose the ability to scale profitably. Without new demand creation, performance campaigns exhaust their addressable audiences and see diminishing returns. Cost per acquisition climbs, and brands find themselves trapped in a cycle of optimizing ever-harder for diminishing results.

The channels with the highest halo contributions aren’t just “nice to have” for brand building; they’re the foundation that makes everything else work. Cutting them to focus on “efficient” performance spend is like trying to fill a leaky bucket faster instead of fixing the holes.

How Prescient uncovers these insights

The halo effect analysis presented here comes from Prescient’s proprietary marketing mix modeling platform, which tracks demand creation and spillover effects across the entire marketing ecosystem. Unlike platform attribution or multi-touch models that rely on user tracking, our approach uses statistical modeling to understand how each channel influences revenue across all touchpoints.

We run this analysis continuously across hundreds of DTC brands, revealing patterns that would be invisible to any single advertiser. This data reflects aggregated insights from brands spanning beauty, health and wellness, home goods, apparel, and other e-commerce verticals.

Our platform doesn’t just measure halo effects, it quantifies them at the campaign level with daily updates, so you can see exactly how your upper-funnel investments flow through to downstream performance. This visibility transforms budget planning from educated guessing into data-driven strategy.

If you’re making decisions based on platform-reported metrics, last-click attribution, or an MMM that doesn’t quantify spillover effects, you’re missing the majority of what your marketing actually does. Book a demo to see how your channels compare to these benchmarks and where your biggest opportunities for growth actually live.