The holiday shopping season isn’t just about Black Friday and Cyber Monday anymore. Our analysis of marketing performance across different industries reveals surprising trends that could reshape your approach to Q4 planning. From early-November efficiency to category-specific spend plays, here are the hidden holiday wins your Q4 plan needs.

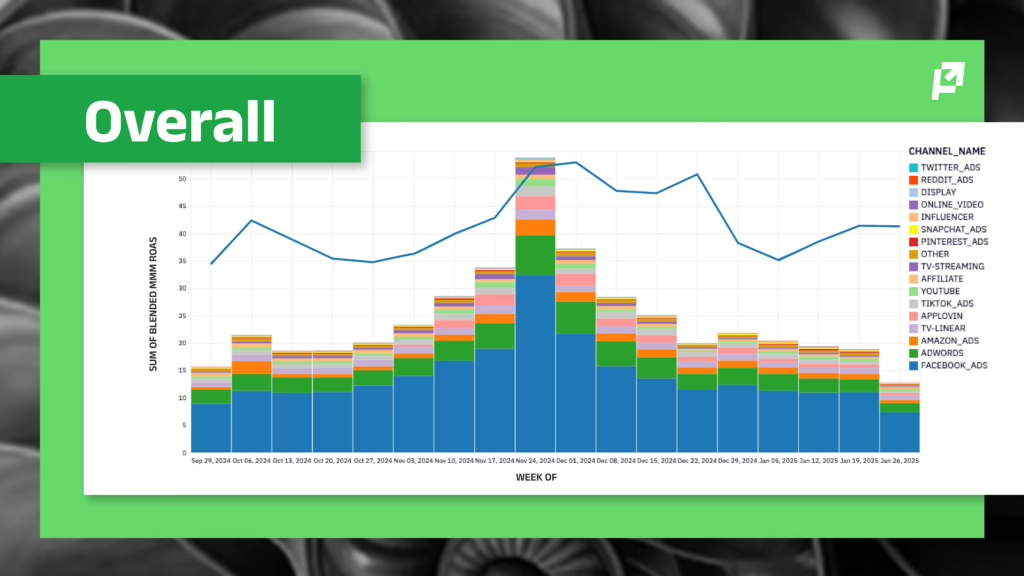

The big picture: Holiday shopping starts earlier than you think

Key Finding: Investing earlier in the season is an unexpected value-play. Marketing efficiency gradually increases starting in November and continues through Christmas. It doesn’t just spike during Black Friday weekend.

What This Means for Your Brand: The old playbook of ramping up spend exclusively for Black Friday and Cyber Monday is leaving money on the table. The savviest brands are tapping into early-November momentum when competition is low and shoppers are already leaning in.

Why This Matters: Pulling the right channel levers earlier can give you a competitive advantage. First, you’re competing for attention when fewer brands are heavily investing. Second, you’re building momentum that carries through the peak shopping periods.

Not all channels follow the same holiday rhythm

The assumption that all marketing channels perform similarly during the holidays is dead wrong. Our data reveals distinct patterns:

Early November Winners

- Meta (Facebook/Instagram): Use Meta for efficiency gains in early November/before peak retail weeks 35–49

- Pinterest: Use Pinterest as early as October for top- and mid-funnel growth

- Amazon advertising: Invest in Amazon the first three weeks in November

December Peak Performers

- Connected TV (CTV): Efficiency is strongest starting with Cyber Monday but peaks right before Christmas

- Traditional TV: Shows similar late-season strength

Strategic insight: This creates an opportunity for smart budget allocation. Instead of treating Q4 as one big spending period, consider a phased approach that matches your channel mix to these efficiency windows.

Category-specific strategies: One size doesn’t fit all

Yes, channel timing is key. But your real strategic advantage comes from recognizing how your product category performs during the holiday season. Our analysis across industries reveals dramatic differences in optimal spending patterns, timing, and channel effectiveness. Some categories see massive efficiency gains during traditional shopping periods, while others actually perform worse (hint: don’t bother with auto parts during peak holiday) when consumers are focused on gift-giving. These insights can help you avoid the costly mistake of following generic holiday advice that doesn’t match your industry’s unique consumer behavior. Here’s what the data tells us about each major category:

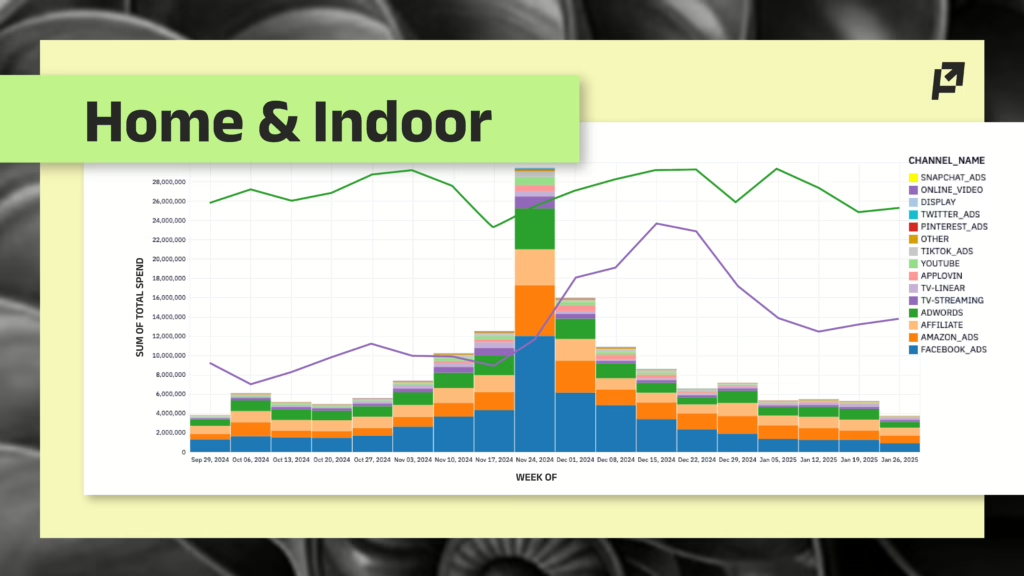

Home & Indoor: The Holiday Spending Champion

Home & Indoor brands show the most dramatic spending increases, ramping up 2.5x during Black Friday week alone. Here’s what makes this category unique:

- Google dominance: While overall the most efficient channel, efficiency doesn’t spike dramatically during BFCM

- Competition reality: The modest efficiency gains suggest fierce competition for ad inventory

- TV timing: Linear and streaming TV efficiency peaks more in December than November

Takeaway: Everyone’s hitting the gas during this peak period on their ad spend. There are efficiency gains here, but they’re modest, so you’ll need to look closely to find them unless you’re willing to spend earlier in the season (on Meta and Pinterest) or later (on TV).

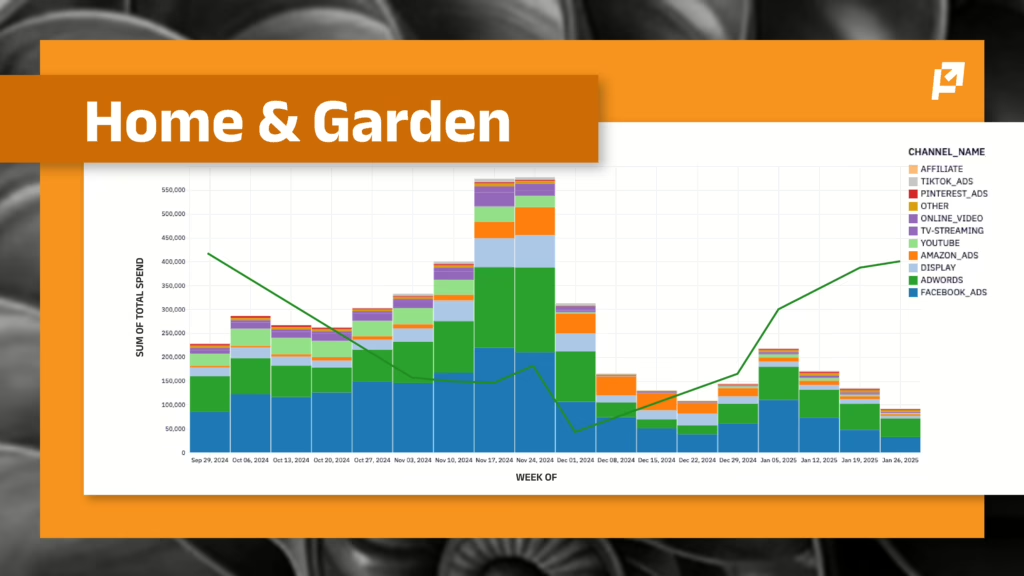

Home & Garden: The Post-Cyber Monday Cliff

This category provides a clear lesson in timing:

- Dramatic drop off: Threading the needle, advertisers see a final opportunity leading in to November to promote products followed by a sharp decrease in spending after Cyber Monday

- Google struggles: Typically strong Google ROAS efficiency “drops off a cliff” in November and advertisers follow suit by cutting spend. Spend and efficiency don’t recover until January.

Action plan: Pull back Google spend during November and December for this category.

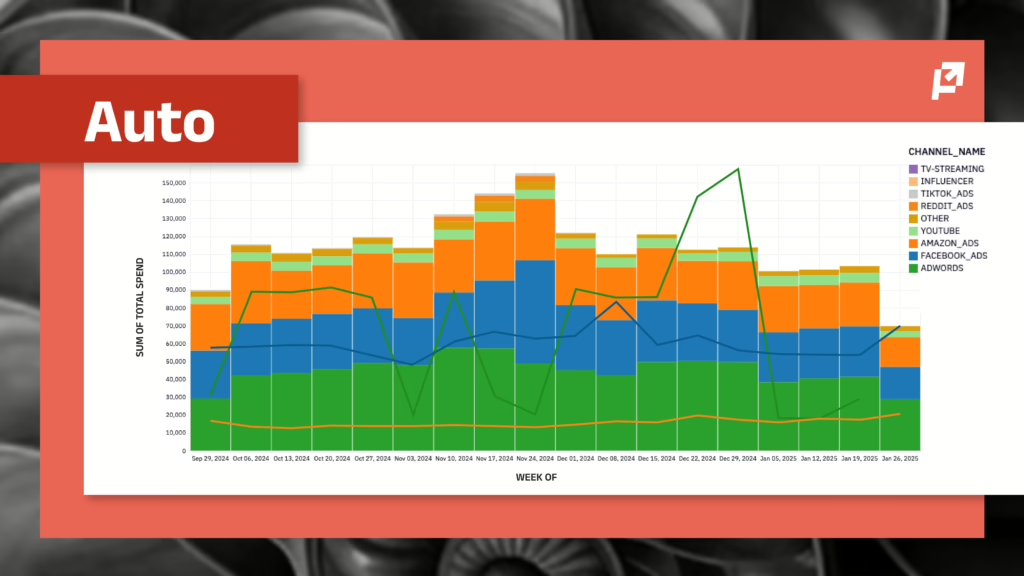

Auto: The Holiday Contrarian

Auto brands tell a completely different story:

- Minimal spend increases: Only 8–15% week-over-week growth in November

- ROAS drop: Significant efficiency decrease in retail weeks 47–48

- Consumer behavior: Shoppers focus on gift-giving, not car purchases

Strategy: Scale back during peak gift-giving weeks. Your category is driven by planned purchases, but during retail weeks 45–49, consumers are focused on more spontaneous buys to get an item before the holiday deadlines.

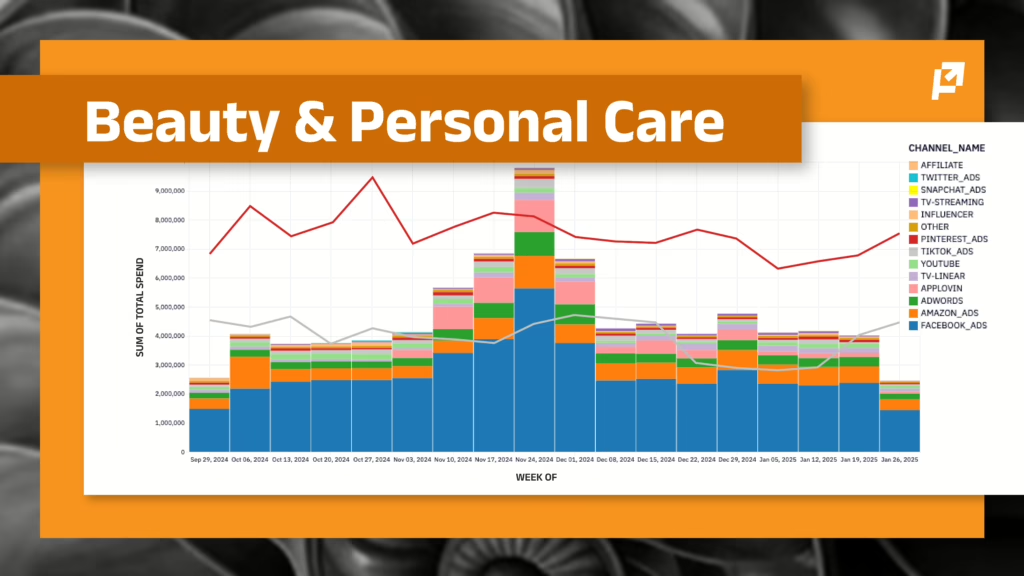

Beauty & Personal Care: The Efficiency Masters

Beauty brands appear to have cracked the code:

- Smart allocation: Spending concentrates in late November and early December when efficiency is highest

- Consumer behavior: Most purchases happen early, allowing brands to return to normal spending levels quickly

Strategy enhancement: Your flighting is in a healthy place, but it may be time to attempt scaling further on Pinterest and TikTok.

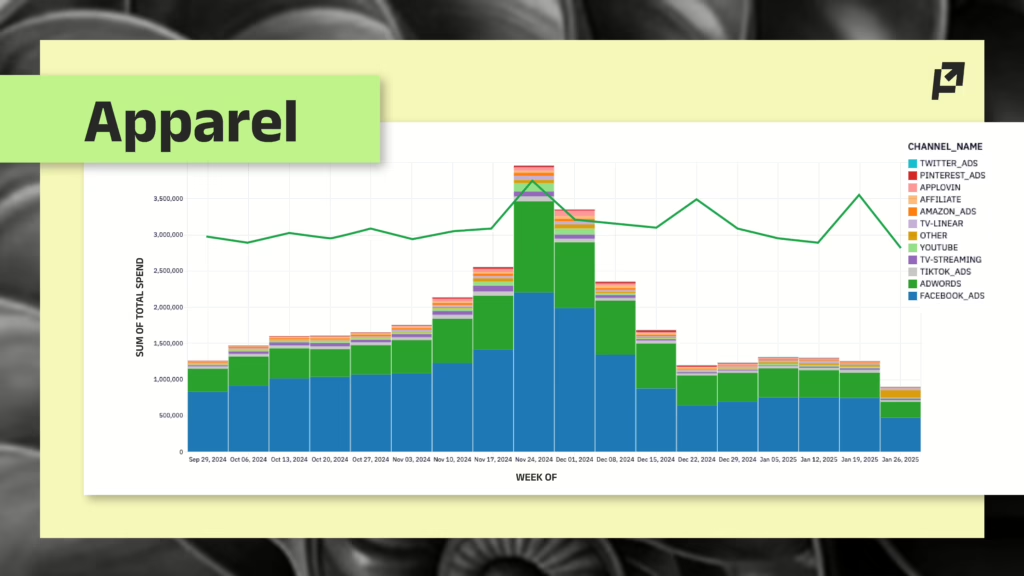

Apparel: Google’s Golden Opportunity

Apparel shows strong holiday fundamentals:

- Peak efficiency during BFCM: Timing aligns well with consumer behavior

- Google advantage: Clearly the most efficient channel during the holiday period

Recommendation: Increase Google budget allocation specifically for the holiday season.

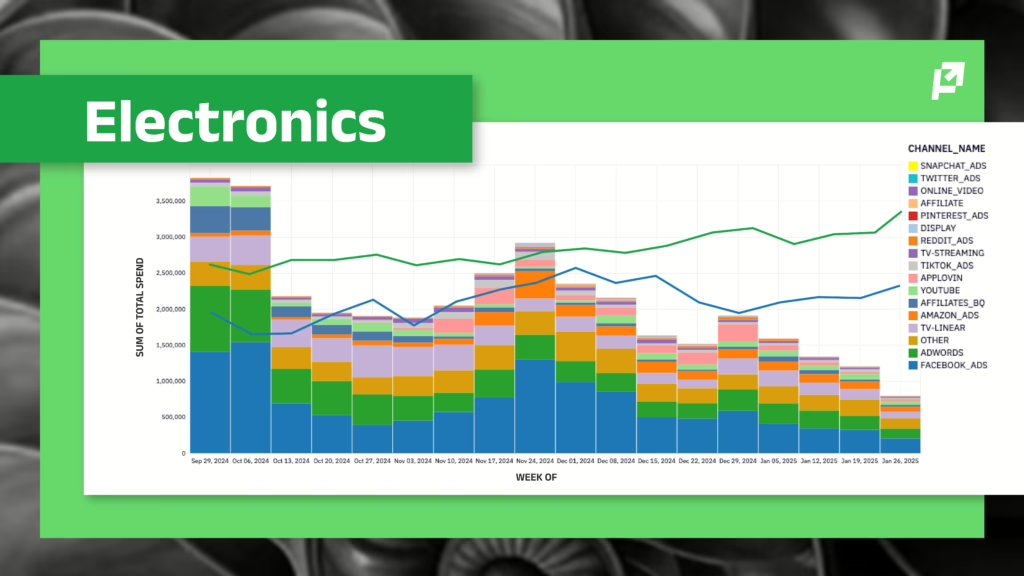

Electronics: The TikTok and Google Story

Electronics brands should note two key channels:

- TikTok and Google leadership: Most efficient channels through Christmas

- Facebook decline: Efficiency drops after Cyber Monday

Strategy shift: Reallocate budget from Facebook to TikTok and Google post-Cyber Monday.

Prime Day vs. Cyber Monday: The surprising truth

Here’s a finding that might change your annual planning: Amazon Prime Day in October was more efficient than Cyber Monday (but not Black Friday, which still remains the top dog) for many brands.

This suggests the marketing landscape is evolving beyond traditional holiday shopping periods. The efficiency gains are becoming more distributed throughout Q4, rather than concentrated in the traditional Black Friday/Cyber Monday weekend.

Planning implications:

- Consider more balanced budget allocation between Prime Day and Cyber Monday

- Don’t put all your efficiency eggs in the BFCM basket

- Early Q4 periods (like Prime Day) might offer better returns on investment

The halo effect surge: Why attribution gets tricky in Q4

During November and December, we see something fascinating happen: halo effects grow by 1.5 to 15 percentage points compared to the rest of the year.

What are halo effects? These are the indirect benefits of your advertising—when someone sees your ad but doesn’t click immediately, then later visits your website directly or searches for your brand. During the holidays, these effects become much stronger.

Why this happens:

- Consumers are more receptive to marketing messages

- Holiday shopping mindset makes people more likely to research and compare

- Multiple touchpoints become more common in the customer journey

What this means for measurement: Traditional click-based attribution becomes less reliable during Q4. The marketing impact you’re seeing in your direct metrics is likely underestimating your true influence on sales.

Actionable takeaways for your Q4 planning

Use these findings to your brand’s advantage by moving beyond generic best practices to implement a c channel mix specific to your product category. These recommendations synthesize all the patterns we’ve identified into practical steps you can implement immediately. Remember, the goal isn’t just to spend more during Q4—it’s to spend smarter by matching your strategy to when and where your audience is most receptive. Here are the essential actions to take:

Start earlier, not just bigger

Begin ramping up spend in early November to capture efficiency gains before peak competition hits.

Match channels to their peak windows

- Invest in Meta, Pinterest, and Amazon advertising early in November

- Scale CTV and traditional TV closer to December

- Adjust Google spend based on your category (strong for apparel and electronics, weaker for home & outdoor)

Think beyond Black Friday weekend

Distribute your Q4 budget across the entire season, including strong consideration for Amazon Prime Big Deal Days in your annual planning. Consider spending to grab an early share of wallet during Amazon Prime’s Fall event in early October.

Plan for attribution challenges

Expect your direct attribution metrics to underestimate true impact. Marketing halo effects are stronger during Q4, so don’t panic if your click-through attribution looks different than usual.

Customize by category

Your industry matters more than generic holiday advice. Use the category-specific insights above to inform your unique approach.

The bottom line

The holiday marketing game has outgrown the “spend big on BFCM” mindset. The smartest marketers are zeroing in on which channels perform when, how their category behaves, and where efficiency peaks actually happen.

Winning brands in Q4 are those that treat it as a strategic, phased campaign rather than a single spending event. Start planning now for early November efficiency gains, and adapt your strategy as the season progresses.

Ready to dive deeper into your brand’s specific Q4 opportunities? This analysis represents aggregate trends, but every brand’s optimal strategy will depend on their unique mix of channels, categories, and customer behavior patterns and Prescient can help reveal those so you can put a plan in place for crushing your Q4 KPIs.

Scott Chang specializes in transforming complex marketing performance data into clear, actionable insights for operators and brand leaders. At Prescient AI, he helps interpret the proprietary MMM and establishes performance benchmarks that equip decision-makers with trusted guidance on marketing efficiency. Previously, Scott led Marketing Analytics at ThirdLove, where he built frameworks to evaluate cross-channel performance and guide investment decisions for a high-growth ecommerce brand. Scott’s analyses at Prescient are designed to be both methodologically rigorous and practically useful.